jetcityimage

I last covered Stellantis N.V. (NYSE:STLA) in April, arguing how it represents a great automotive play together with Tesla. Today, I am revising my recommendation after two earnings releases and Stellantis’ investor day, which took place in June.

Thesis: Stellantis is a strong company in a challenging industry, but North America operations need careful monitoring

Stellantis reported disappointing results for H1 2024, with Revenue and Net Profit decreasing by 14% and 38%, respectively.

I believe this decline is due to broader industry challenges rather than issues specific to Stellantis. The automotive sector is experiencing a “normalization” period following previous supply chain constraints and strong consumer demand.

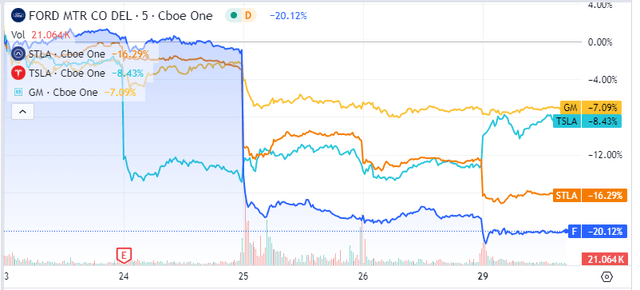

This is further confirmed by the troubled earnings season reported by other automakers, including Ford Motor Company (F) and General Motors Company (GM). Most automakers have seen a significant decline in their stock prices after reporting earnings, with Stellantis’ stock price decline being second only to Ford’s.

F, GM, STLA and TSLA stock performance after earnings (Seeking Alpha)

In this broader industry context, I believe Stellantis remains a very inexpensive company, trading at a significant discount compared to its peers. Stellantis has a unique global and local reach, supported by its vast portfolio of legacy brands, which remain relevant across different markets and diverse customer segments.

The only element that truly worries me is Stellantis’ decline in North America, its second-largest region by revenue and the top region by absolute operating income. The company’s product portfolio in North America is very outdated, which is evident in the H1 2024 results, in my view.

Management appears to be aware of this issue and has emphasized their focus on “fixing” North America in the coming months, including the launch of 20 new vehicles. Nonetheless, I still view this as a fundamental risk to the company and will closely monitor the evolution of Stellantis’ business in North America for the rest of 2024.

Given its attractive valuation and solid execution amid industry challenges, I rate Stellantis a BUY at current price levels, expecting an upside of 30% to 50%.

What I (still) like: Stellantis’ “glocal” product strategy and market valuation

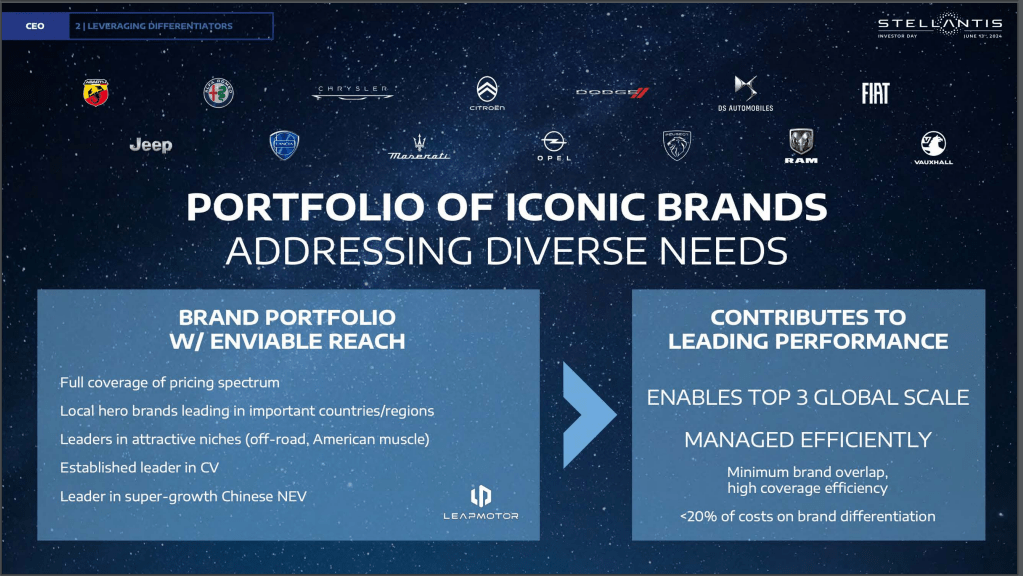

In my first article about Stellantis, I argued how one of the company’s competitive advantages is represented by its legacy brands. Many of these have high local brand awareness in specific regions or countries. For example, Fiat is a market leader in Italy and Brazil. Peugeot is a market leader in France. Opel has a strong brand recognition in Germany.

Stellantis’ different cars, all based on the same platform (Author own work)

Stellantis can deliver different, unique and locally relevant vehicles using the same automotive platforms. This way, the company can achieve economies of scale while staying relevant to different markets and customer segments.

I believe not many automakers have the same breadth of car brands that Stellantis enjoys. In my opinion, only Volkswagen AG (OTCPK:VWAGY, OTCPK:VLKAF, OTCPK:VWAPY) can truly compete with Stellantis in terms of the breadth and strength of its brand portfolio.

Stellantis Portfolio of Iconic Brands, Addressing Diverse Needs (Stellantis’ Investor Day Deck)

During its investor’s day, Stellantis spelled out exactly this competitive advantage. The company calls it “one size cannot fit all” (in slide 8) and “be local in major regions” (slide 11).

I, personally, see customer obsession as one of the key drivers behind any company’s success. In this regard, I believe Stellantis understands the importance of having a diversified portfolio of brands that can address different customer needs, and I see this as a key strength of their management.

Stellantis valuation: still too good to ignore

The other element I like about Stellantis is its valuation. Granted, the company is not US-based, and this, in my opinion, entails some discount in its valuation against US peers.

This said, Stellantis’ valuation is very generous, in my view. Stellantis currently trades at a 3.33 forward P/E ratio, compared with 5.73 and 4.48 for Ford and GM, respectively. The company also has a significant dividend yield at 6.9% at the time of writing.

More importantly, Stellantis still enjoys a positive Net Debt position to the tune of roughly $19 Billion — something that few automotive peers can boast at the time of writing. For reference, Ford and GM’s net debt positions are at above a negative $100 Billion Net Debt Position at the time of writing.

I believe that if Stellantis demonstrates it can execute in the North American market, its valuation will need to align with those of Ford and GM.

Despite its positive net debt position, I expect Stellantis should trade at a P/E ratio of approximately 5, in line with its American peers with weaker debt positions. This is given its distinctly European focus, which I believe warrants a discount. This suggests a 30% to 40% upside from current levels.

I think Stellantis’ juicy dividend is safe, for now

Stellantis pays a juicy dividend of more than 6% at the time of writing, although this is paid on an annual basis (around March) and it is subject to forex risk for American-based investors, as it is paid in Euros.

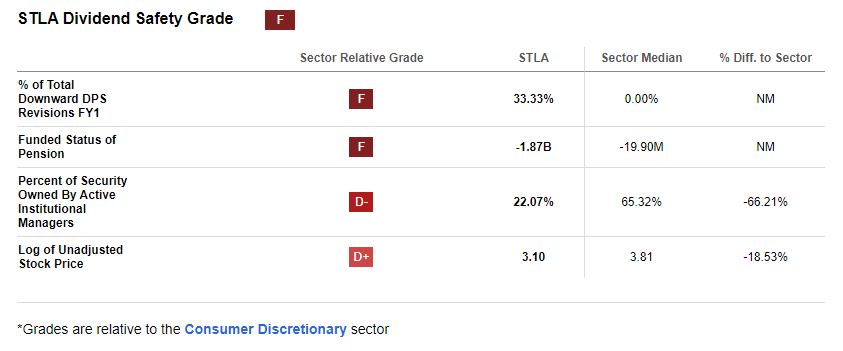

STLA Dividend Safety Scorecard (Seeking Alpha)

Interestingly, Seeking Alpha is assigning an “F” grade to the company’s Safety Grade. I do not personally agree that Stellantis will cut its dividend. The reason is mostly political and relates to Stellantis historical stakeholders.

Stellantis is the fruit of the merger between Fiat Chrysler Automobiles (FCA) and Peugeot Automobiles (PSA). The main shareholders of Stellantis are the French Government, the Peugeot family and the Agnelli family (the family who founded Fiat in the early 20th Century). Together, these shareholders reach almost 30% ownership of the automaker.

It is my belief that these institutional shareholders all expect continuity in the company’s dividend payment policy. This is similar in some way to what the Ford family represents for Ford as an automotive company. Historically, the Ford family has pressured the company to pay a consistent dividend, in part because it retains a significant amount of control over the company via special class shares.

While I believe strategically Stellantis would benefit from a dividend cut and reinvestment in R&D, I think management will not cut it due to political pressure from legacy shareholders.

What I do not like: decreasing profitability and revenue, product weakness in the U.S.

There is no doubt in my mind that Stellantis’ H1 2024 results were disappointing. In management’s own words:

The Company’s performance in the first half of 2024 fell short of our expectations, reflecting both a challenging industry context as well as our own operational issues.

Stellantis’ used to boast among the highest profit margins of the automotive industry, reaching roughly 15%. This is not the case anymore, and the Adjusted Operating Margin (AOI) registered in the first half of 2024 is 10%. On top of a significant AOI decline, Stellantis also registered decline in the following financial metrics when compared to H1 2023:

-

A 14% decline in overall Revenue

-

A 48% decline in Net Profit

-

An Industrial Free Cash Flow near zero.

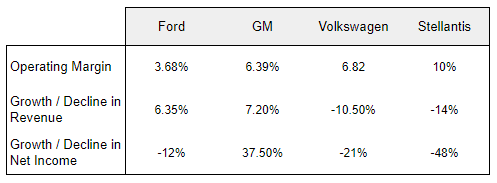

While these figures might seem troubling at first sight, I believe they must be put into the context of the automotive industry. In the table below, I compare Stellantis’ key metrics with those of Ford, General Motors and Volkswagen. All data refers to the last quarter’s results available for each company.

Ford, GM, Volkswagen, Stellantis key metrics in comparison (Author’s elaboration of last quarter publicly available data)

In my view, Stellantis’ latest results are understandable given the broader context of the automotive industry. The automotive industry enjoyed almost unprecedented pricing power on the back of post-pandemic supply chain constraints and a rise in consumer demand for vehicles. Those times are now over, and I think automakers are entering a normalization phase.

In this new normalization phase, I think pain for most automakers is inevitable, and we will most likely see some consolidation in the upcoming years.

I believe Stellantis’ net debt position and competitive margins, together with its strong “glocal” product strategy, put the company in a fairly strong position in the automotive industry. Together with its inexpensive valuation — which I have covered in the previous chapter — these are the reasons why I recommend a BUY for this stock.

Stellantis and Tesla: still a great trade idea, in my opinion

The fundamental issue with Stellantis, in my view, is not whether the company is interesting at these levels (it is, in my opinion). Instead, it is rather whether it makes sense to enter the automotive industry overall at this point, when carmakers are entering a new period of normalization.

I see the automotive industry as a price sensitive, capital intensive business. It is an industry that some investors could see as fundamentally unattractive because of its dynamics and financial characteristics.

I like the automotive industry and I assume readers will agree, as they have chosen to read an article about Stellantis. I find one of the best ways to be exposed to it is to hold Stellantis and Tesla, Inc. (TSLA) together.

This combination offers investors the opportunity to own an “artificial” company that is a leader in Electric Vehicles ((EVs)) and technology, while also having a strong presence in legacy segments such as Internal Combustion Engines (ICE) and commercial vehicles.

In this regard, I see my previous investment thesis as unchanged.

Stellantis’ European leadership might be losing its grip on the US — this is my biggest worry.

What worries me the most about Stellantis’ latest report is the company’s weakening positioning in the crucial US market.

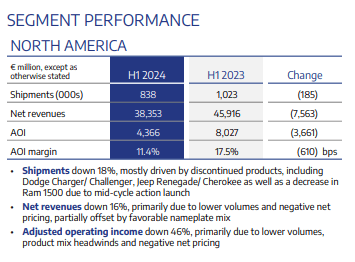

North America performance, STLA (Stellantis’ H1 2024 investors’ report)

Shipments in H1 2024 were down 24% for Stellantis, driven by discontinued products. North America was the region where Stellantis was hit the hardest in H1 2024 when looking at absolute numbers. $7.5 Billion of revenue and $3.7 Billion of AOI were “lost” in the region when compared to last year’s results.

Weaknesses in North America are especially troubling when considering how the region has an AOI margin 65% higher than that of Europe. While AOI in the Middle East and South America is even higher, North America represents almost 30% of Stellantis’ total sales, even after the decline in H1 2024. It is by far the region that contributes the most to Stellantis’ profits, and it is therefore its most strategic, in my view.

Stellantis’ management seems aware of the issue, in my opinion. The company’s CEO, Carlos Tavares, explicitly called out North America in multiple instances, and he mentioned the company has started an “exciting product blitz,” with 20 new products to be launched in the remaining part of 2024.

While this reassures me to some extent, the company’s lackluster strategy in North America remains my main concern with an investment at Stellantis at these levels. This is something I will cover in more detail in the next section of this article, dedicated to risks to my thesis.

Risks to my thesis

I believe the main risk to my bullish thesis for Stellantis is that the company ends up losing its ground in the crucial North American car market.

Stellantis is, in my opinion, an indisputable European-led company. Most of its top management comes from either Fiat Chrysler Automobiles or PSA, the two car companies that merged into Stellantis. As I have outlined before, Stellantis’ top shareholders are either the Elkanns or the Peugeots, two European families, or the French government.

Despite having confidence in Tavares as an automotive CEO, there is a risk that the company loses its grip on the US. On top of the disappointing quarterly results I just discussed, I consider the current product line up of Stellantis’ legacy American brands an element of concern that management needs to address urgently.

Dodge, Chrysler, and RAM all offer a very outdated product line-up, in my opinion. Except for the Dodge Hornet — which has however experienced lousy sales so far — all vehicles currently offered for sales by these brands are coming from the legacy FCA business and all date several years back. Some cars, such as the Chrysler 300 and the Dodge Durango, date as far back as the times of Daimler-Chrysler in the 1990s.

I see the saga of the Dodge Hornet as a warning for Stellantis’ strategy in North America. The Dodge Hornet is a rebrand of the Alfa Romeo Tonale and, based on its sales, is not appealing to the American market. I think Stellantis needs to step up its game in the USA to demonstrate it can stay relevant in that crucial region.

I will closely watch the launch of new US-dedicated products in the upcoming months, including the new RAM 1500. In my opinion, these will be crucial to gauge whether Stellantis can replicate its ‘glocal’ product strategy in the North America region.

A remark about Maserati — shareholder’s catalyst or dead weight?

In my last article about Stellantis, I outlined how Stellantis’ might decide to spin-off Maserati, similarly to what Fiat Chrysler did to Ferrari N.V. (RACE) years ago. It seems however that Maserati might simply be sold, rather than turned into a separate company. Stellantis’ CFO confirmed Maserati could be sold just a few days ago.

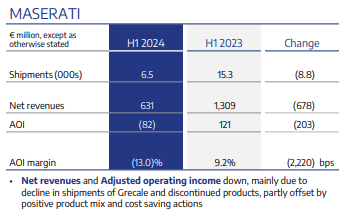

Maserati results, H1 2024 (Stellantis’ H1 2024 Investors’ deck)

This change in strategy, in my view, is because Maserati is not profitable anymore as of H1 2024.

As a car enthusiast, I could spend many paragraphs detailing what, in my opinion, has gone wrong with Maserati. This would focus on outdated product categories such as luxury sedans to an overall wrong market positioning of Maserati to compete with Porsche.

The issue, in my view, is that finding a buyer for an unprofitable car brand will be exponentially more difficult than what it was just 1 year ago. I believe Stellantis’ might end up selling Maserati for a symbolic amount of money, just to “get rid” of an unprofitable and difficult brand. A spin-off into a separate company seems completely off the table, at this point.

This scenario will not unlock value for shareholders as I previously estimated, and I therefore do not consider it anymore as a catalyst for Stellantis.

Conclusion

In my opinion, Stellantis is a well-managed company operating in a difficult industry. The automotive sector is currently experiencing a period of ‘normalization’ after an exceptional phase of pricing power driven by strong consumer demand and supply chain bottlenecks.

While headwinds will persist for carmakers, I believe Stellantis is well-positioned to overcome them. This is due to the company’s positive net debt position and “glocal” approach to products.

Despite concerns about the decline of Stellantis’ North America business, I think the market has been overly harsh on the company. The current valuation is too cheap to ignore, especially after the recent market correction. I assign a BUY rating to Stellantis and anticipate a 30% to 40% upside from current stock prices.