Summary

- Jeffries forecasts a 17% jump in business jet deliveries in 2024, with 674 aircraft expected to be delivered.

- Gulfstream’s G700 delays impacted revenue in 2023, but deliveries are expected to increase from 114 in 2023 to 155 in 2024.

- Despite supply chain challenges, Gulfstream’s revenue and demand for the G700 and G800 are substantial, with an increasing market share valued at $90.2 billion.

In 2023, there was some uncertainty in the private jet market. Would the post-pandemic boom continue, or would the market fall into decline? In 2020 and 2021, there was a 20% increase in first-time aircraft purchases. Charter operators saw a considerable rise in demand for their services for passengers who suddenly couldn’t travel or had health concerns. Some business or first class travelers changed to flying privately and never went back. Business aviation weathered the storm, but no one knew if the bubble would burst.

Photo: Gulfstream Aerospace

Looking at business jet deliveries from the top five aircraft manufacturers, Jeffries, an investment research firm, forecasts a jump of 17% in 2024. There were 652 deliveries in 2019, pre-pandemic, compared to 575 deliveries in 2023, and in 2024, 674 aircraft deliveries are expected to take place. What is the market outlook, in particular, for Gulfstream?

Delays in certification

Leading the growth is the new ultra-long-range business jet, the Gulfstream G700, which will soon enter service. The G700 Federal Aviation Administration (FAA) certification process was initially set for the end of 2023 but has been delayed for several months. Due to this, Gulfstream’s revenue was short by more than $1 billion in the final quarter of 2023. Fifteen of the popular business jets have been pushed into 2024 because of the delays.

|

Gulfstream G700 Performance |

|

|---|---|

|

Maximum Range |

7,750 NM |

|

Long-Range Cruise |

Mach 0.85 |

|

High-Speed Cruise Range |

6,650 NM |

|

High-Speed Cruise |

Mach 0.90 |

|

Maximum Operating Mach Number (Mmo) |

Mach 0.935 |

|

Takeoff Distance (SL, ISA, MTOW) |

6,250 ft |

|

Initial Cruise Altitude |

41,000 ft |

|

Maximum Cruise Altitude |

51,000 ft |

Gulfstream business jet deliveries increased from 114 in 2023 to 155 deliveries expected this year. Forty-nine G700 have already been produced, of which 30 are expected to be delivered this year. It is hoped that the G700 will be certified within the coming week, and the rollout can begin. The Jeffries forecast also predicts that the G800 certification process will start this year’s end and that ten of the aircraft will be handed over.

Photo: Gulfstream Aerospace

However, if there are any further delays with certification, it puts at risk $2.3 billion of revenue. There is a robust demand for both the G700 and G800, and General Dynamics, the parent company of Gulfstream, posted sales of $42.3 billion for 2023. This figure is up 7.3% from $39.4 billion in the previous year.

Continued demand

It is expected that figures will continue to rise this year despite supply chain issues and labor shortages. General Dynamics is predicting a revenue increase of 9% to $46 billion. The post-pandemic demand for Gulfstream aircraft is not diminishing, and maintenance, repair, and overhaul activity is brisk. In 2023, 111 aircraft were delivered instead of the original number of 145 aircraft.

Analysts predict that after the delays in certification, Gulfstream will have a fast rebound this year when the G700 finally enters the market. Fifteen examples of the G700 are expected to be delivered this quarter. However, the Gaza conflict has affected the production of the G280, which is produced in conjunction with Israel Aerospace Industries. Supply chain issues and geopolitical tension in the Middle East are impacting shipping routes.

Down to the figures

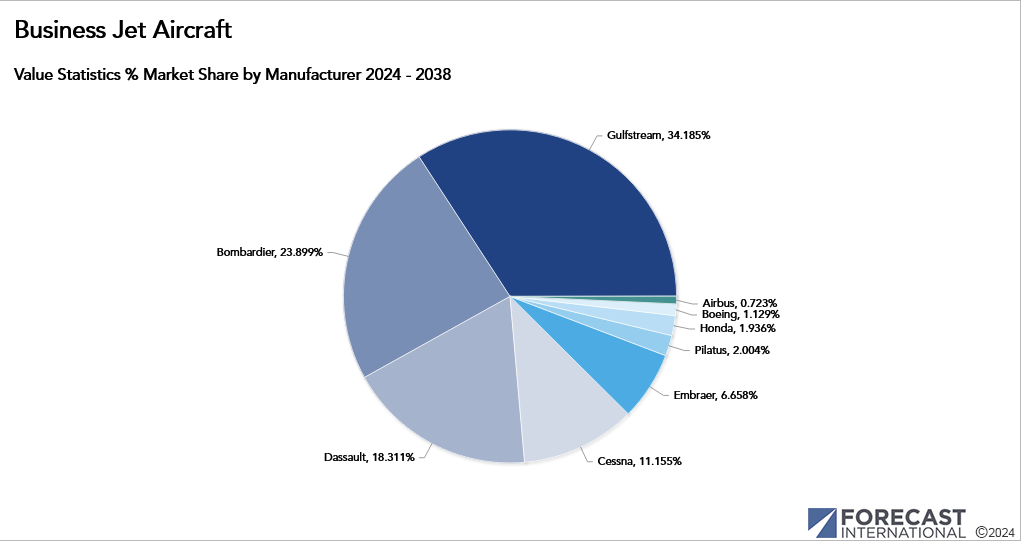

Forecast International’s Civil Aviation Forecast reports that the Gulfstream market share is second to that of Cessna, which takes first place. Textron Aviation (owner of Cessna) is expected to produce 1,949 business jets, representing a 24.8% market share. Gulfstream is expected to produce 1,593 business jets, holding a 20.2% share of the market.

Photo: Forecast International

Bombardier follows in third place with a 17.1% market share and 1347 business jets to be produced. Embraer holds a 16.5% market share, with 1347 aircraft to be built. Dassault holds the smallest share, at 9.4%, and 739 aircraft are expected to be made.

However, because of the larger business jets produced and the higher cost of each unit, Gulfstream comes out in top place in dollar value. Where the market is measured in terms of monetary value, the picture looks slightly different. Gulfstream’s production of business jets is worth $90.2 billion and holds a market share of 34.9%.

Photo: Gulfstream Aerospace

Bombardier follows with production worth $68.5 billion and a market share of 25.4%. Dassault holds a 16.4% market share, worth a total of $42.3 billion. Cessna has an 11.4% market share, and aircraft production is expected to reach $29.4 billion. Embraer follows with a 7% market share, worth $18 billion in total.

In conclusion

Honeywell’s Global Business Aviation Outlook predicts 8,500 new business jets will be delivered between 2024 and 2033 at $278 billion. It seems that the private jet industry is still stable, and the upward trend in demand for private jets will continue.

Backlogs and limits on production may still happen. The lack of raw materials may affect the number of new aircraft entering the service. Production numbers and pricing will stay around the same. In Gulfstream’s case, what was sold and not delivered in 2023 will be delivered this year. The market outlook for Gulfstream remains positive and will no doubt continue to increase over the coming years.