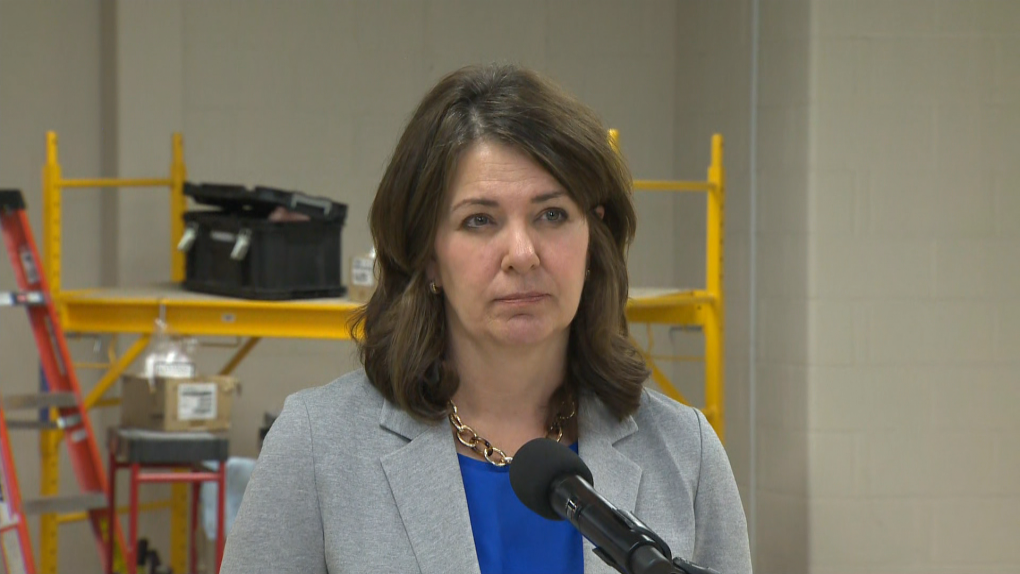

Premier Danielle Smith says government-run public auto insurance is off the table for Alberta, despite a recent report suggesting it would save drivers hundreds of dollars a year in premiums.

The report, by Oliver Wyman and Nous Group, was commissioned by the Alberta Treasury and Finance Board.

It suggests that Alberta could significantly reduce insurance costs by adopting a no-fault insurance system like Manitoba or Saskatchewan, which provide universal insurance with coverage for injury and vehicle damage.

Unlike Alberta’s tort system, no-fault models don’t use litigation to recover costs. Instead, each person’s insurance is responsible for compensating them after an accident.

Making the switch, Nous estimated, could save Albertans around $730 a year on premiums for an estimated $2.1 billion in consumer savings across the province.

As of Thursday, a government survey on the issue had received 12,000 responses. It will remain open until June 26.

While that consultation is ongoing, Premier Danielle Smith said Wednesday the province is unlikely to switch from private to public insurance due to the cost.

Nous estimates Alberta would pay between $100 million and $500 million in start-up costs, with an initial injection of $2.3 billion in capital reserves needed to cover claims.

Moving to a government-run insurance system would also cut down provincial tax revenue by an estimated $163 million to $171 million per year.

“The sticker shock of bringing through a fully publicly-funded auto insurance program in Alberta made all the ministers’ eyes pop,” Smith said, adding she believes “the appetite for a full Alberta-run public insurance system is very low.”

The province has signalled that changes to insurance are coming in the fall, and Smith said those include an option for drivers to opt in to no-fault system at a lower cost.

“There are lots of Albertans who are prepared to pay the extra dollars so that if they do end up – heaven forbid – in a terrible accident, they can hold someone accountable through the legal process,” Smith said.

Aaron Sutherland, vice president of the Insurance Bureau Canada (IBC), said the ability to sue other drivers is a big factor in raising prices.

“Where Alberta stands out relates to the legal costs underlying your premiums,” Sutherland said. “Those costs are three times higher than other provinces in Canada … They’ve grown to 31 per cent in the past few years.”

A hybrid system where smaller claims are handled outside the courtroom could help, he said.

“Eighty per cent of auto insurance accidents result in minor injuries,” he added. “That could save drivers several hundreds of dollars each year, while preserving the right to sue for any serious injuries.”

In addition to reforming the current tort model, IBC wants the province to cut its four-per-cent insurance premiums tax and remove the cap on premiums for high-risk drivers, which a report found costs safe drivers around $180 million a year.

The Nous report said those changes would result in savings but would not lower prices as much as a new public model.

Whatever the province has planned, Sutherland said it needs to act soon if it wants to improve affordability before the next election.

“We need 18 months with whatever (they) come up with to price it, and then your regulator is going to take six months to tell us that our rates are approved or not, so it’s like two years,” he added.

“We’ve got to get going if we want to see this in the near future.”

With files from CTV News Edmonton’s Chelan Skulski