Asdaâs billionaire owners have borrowed millions of pounds from their petrol forecourt business to repay debt that was taken out to buy two private jets.

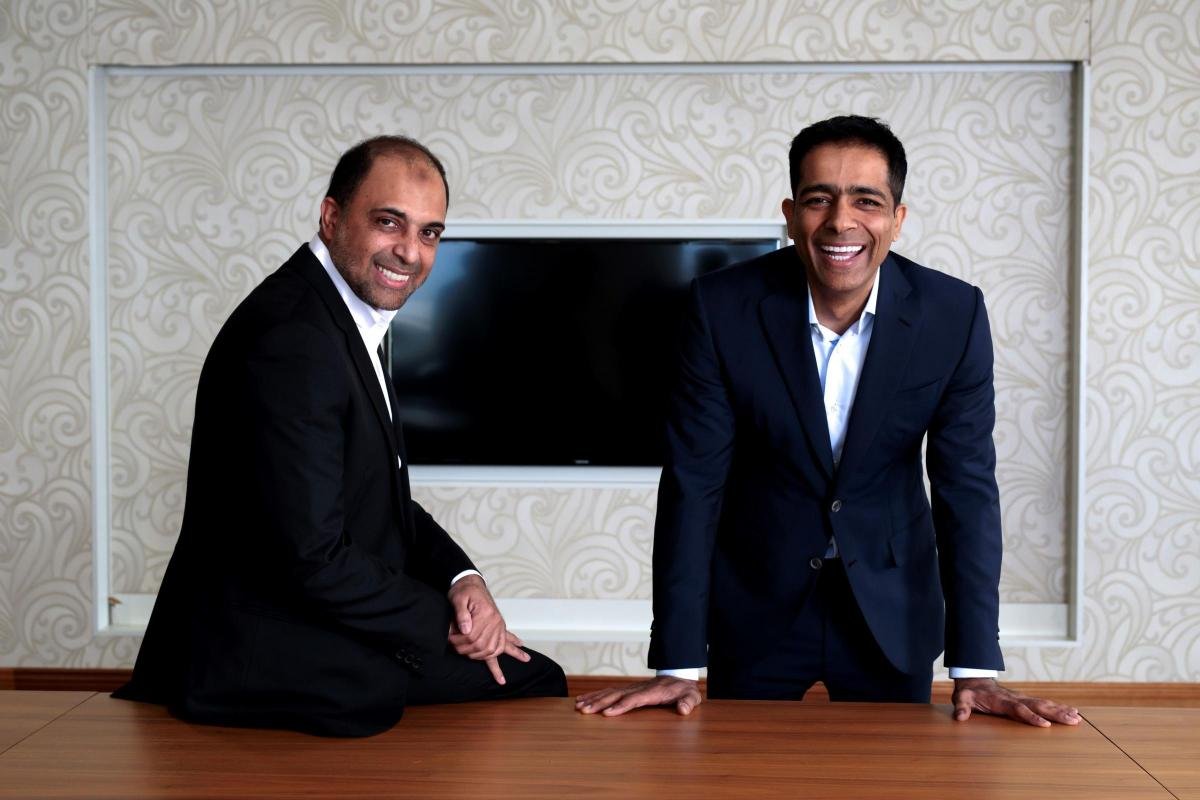

EG Group lent Mohsin and Zuber Issaâs personal private jet companies £5.6m in 2022, corporate filings show, on top of the £31m in unsecured loans it gave them to buy the planes in 2018, The Financial Times reported.

Of the loan, £4m went to the company through which they own a Bombardiar Global 6000, while the rest went to a company owning a smaller Bombardier Challenger 350.

The planes are owned through two Isle of Man-registered entities, which borrowed from Bank of America, which also charges interest and has security over the jets.

Subscribe to Retail Gazette for free

Sign up here to get the latest news straight into your inbox each morningÂ

In 2022, it emerged that EG’s loan terms had been pointed out in an audit and that the Issa brothers would begin to be charged backdated interest. However, EG has not disclosed the rate.

The £5.6m figure would be enough to cover the majority of interest repayments to EG from the two Isle of Man companies, however, a source told the Financial Times that this money was used to pay interest and principal on external debt owed to third parties.

All fresh loans are due to be paid in full in November.

EG Group said: “As previously disclosed to the Financial Times in 2022, loans to the [Isle of Man] companies are fully disclosed in the EG Group accounts and continue to be so.

“These loans have been provided at rates comparable to the average commercial rate of interest. The interest has been identified and recognised within EG Groupâs finance income.”

The Issa brothers have come under scrutiny for their complex financial structures related to Asda and EG, which they both own with the backing of private equity firm TDR Capital.

Click here to sign up to Retail Gazetteâs free daily email newsletter